Economic Team

Our role

-

Research the economic impacts of the Shared Grove Pathway project on Grove Park’s commercial district

-

Demonstrate positive economic benefits to residents, including employment, transportation, and food access

-

Calculate initial and ongoing costs of implementation and suggest funding mechanisms

Rachel Dekom

History & Sociology Major

Mira Kaufman

Public Policy Major

Findings

Proposals

-

Support local businesses, entrepreneurship, and job growth.

-

Utilize available lots.

-

Connect community members to transit hub.

-

Increase neighborhood food access and support existing urban farming initiatives.

Introduction

The Economic Team was tasked with researching the economic benefits and impacts of the Shared-Grove-Pathway project’s implementation. We assessed the current state of the economy of the Grove Park neighborhood, including the success of current local businesses, potential for job growth, and transportation and food access. We then researched the economic impacts of similar projects to learn how introducing a shared use path could impact Grove Park’s economy. We also calculated the proposed cost of the project, including both the initial cost and the cost of ongoing maintenance. Our team consisted of two members: Mira Kaufman and Rachel Dekom. Mira is a fourth-year Public Policy undergraduate, and Rachel is a fifth-year History and Sociology undergraduate

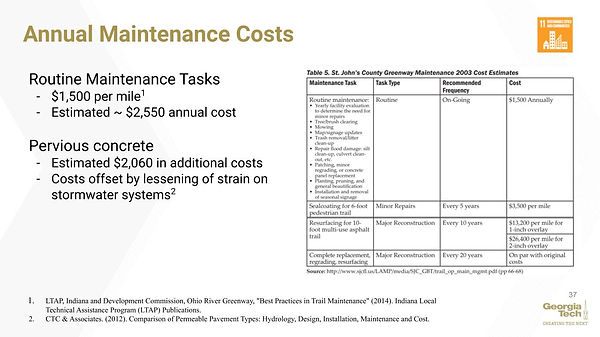

Project implementation cost

Based on our analysis of a proposed Model Mile trail section in the city of East Point (PATH Foundation, 2016), we estimate that the total cost of implementing the greenway will be $2.5 million. The range of costs could be as low as $2 million and as high as $3 million. The figure below shows the breakdown of costs for one of the sections of the East Point trail. This section of trail is slightly shorter than the proposed greenway, which is why the estimated cost of our greenway is slightly higher than the trail proposed below. This relatively low cost addresses SDG 11: Sustainable Cities and Communities.

Funding Options

Paths and parks utilize various funders and income streams to finance maintenance. Community Improvement Districts (CIDs) are a popular public-private funding mechanism in the State of Georgia and can maintain trails with their revenue. CIDs have been created throughout Atlanta for the “provision, acceleration, supplementation or enhancement” of governmental services including “Parks and recreational areas and facilities” and “public transportation” (City of Atlanta, n.d.). CIDs’ “primary financing mechanism is an additional property tax, which is levied on commercial and industrial properties that are not otherwise tax-exempt” (Kuhn, 2016). The Grove Park neighborhood does not currently house a CID. However, if residents expressed support, a new CID could form in this area.

Another strategy for funding trail maintenance could involve utilizing a Tax Allocation District (TAD). Also known as Tax Incremental Financing (TIF), a TAD is a tool used by governments to stimulate property value growth and economic development (Greenbaum & Landers, 2014). In the TAD, the government assesses property taxes, and this assessment becomes a baseline value. Then the area borrows money and completes infrastructure improvements to increase property values and encourage private sector investment. After the improvements occur, any increase in property tax revenue above the assessed baseline value goes to returning the borrowed money used to build the infrastructure improvement.

Areas in Atlanta, including the Beltline and Atlantic Station, have successfully used TADs, and the revenues from TADs are sustainable as long as property values continue to rise. To approve a TAD in Georgia, the proposal must prove that the area has not grown through private investment and will not be subject to growth or development without the approval of a TAD. The Grove Park neighborhood will likely meet this requirement because there is currently little development in the area.

Currently, a TAD exists in the area surrounding the proposed Groveway trail. The Hollowell/M.L. King Tax Allocation District runs along Hollowell Parkway, but starts slightly beyond the proposed Groveway trail. As shown in Figure 4, the Hollowell TAD ends at Eugenia Place, 0.3 miles west of the eastmost end of the Groveway trail. If local lawmakers implement policy to expand the existing TAD to extend down Hollowell Parkway, this funding model could be used to finance the development and maintenance of the Groveway.

Transportation Special Purpose Local Option Sales Taxes (TSPLOSTs) are another potential funding source for the sidepath. The Path400, a 5.2 mile greenway in Buckhead, has received TSPLOST and Federal Highway administration funding through the Atlanta Regional Commission. However, receiving these forms of funding necessitates support from the Atlanta City Council and Atlanta Regional Commission. TSPLOSTs have been highly effective in Georgia; however, the Atlanta TSPLOST currently faces some budget shortfalls. Acquiring support through the TSPLOST program may prove difficult as there are numerous competitors for the funding. The Federal Highway Administration also offers potential funding in the form of the Georgia Recreational Trails (GRT) program. The GRT program is a competitive grant that can be used to partially fund transportation related projects such as sidepaths.

Conclusion

The Groveway trail provides a unique opportunity for economic development in the Grove Park neighborhood. While stimulating connectivity and promoting public health, the trail could also increase commercial activity and support the revitalization of Hollowell Parkway and the surrounding residential areas. Financing this project may require the development of a Community Improvement District and the extension or creation of a Tax Allocation District. Both strategies are feasible and have been proven successful by past Atlanta development projects.